Debt factoring is a type of invoice finance, it is also known as invoice factoring.

How does it work?

- Once you’ve raised an invoice, you will receive up to 90% of its value straight away.

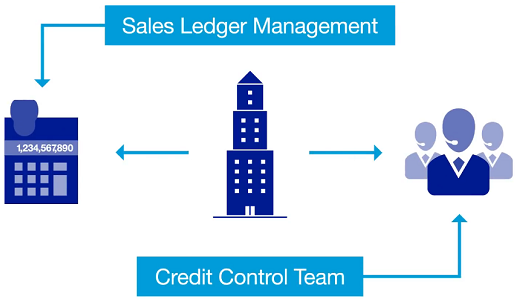

- We will manage your sales ledger and our discreet credit control team will collect payments from your customers on your behalf.

- When your client settles the invoice you will get the remaining balance less an agreed fee.

Is it suitable for my business?

If your business operates in the B2B sector and has an approximate turnover of at least £500,000 it could be eligible. If some of your turnover is export, then we can also consider providing finance against these sales, especially if combined with our bad debt protection solution.

What are the advantages and disadvantages of debt factoring?

Advantages

- Cash is released instantly, freeing up working capital and improving cash flow.

- It is an useful option for small businesses that don’t have a finance team in-house, particularly if you have customers who aren’t always reliable when it comes to paying on time.

- Maintain customer relationships by allowing a friendly credit control team to collect payments on your behalf.

- You will have the full support of a relationship manager and access to your own online account to enable you to view your facility whenever you need to.

- Operate secure in the knowledge that you are covered should your customers get into financial difficulty with our optional bad debt protection service.

Disadvantages

- There are various fees to be aware of, which in some instances could make debt factoring more expensive than other funding options.

- Without bad debt protection you could be at risk from customer insolvency.